Crowning of the New King: This could be the impression many people have after witnessing the formal assembly of BYD’s 5 millionth new energy vehicle. BYD holds a unique confidence. As the first company worldwide to achieve this scale of 5 million new energy vehicles produced, BYD’s momentum far surpasses the entire industry.

From the debut of the first new energy vehicle to the milestone of 1 million, BYD took 13 years; Reaching from 1 to 2 million cars took 1 year; Advancing from 2 to 3 million took only half a year; Now, reaching the 5 million mark, BYD accomplished it in less than 9 months. Behind the dazzling exterior lies many unknown bitter experiences.

During this event, it awakened Wang Chuanfu’s inner sensitivity, as he spoke of BYD’s past challenges and hardships, becoming choked with emotion.

“From 2017 to 2019, BYD faced three consecutive years of substantial profit decline. Especially in 2019, our net profit was only 1.6 billion. But in terms of research and development, that year we still invested 8.4 billion.”

“Many people say that producing new energy vehicles is just burning money. BYD, at one point, regarded survival as its main goal. Although this path was difficult, BYD has been walking it for twenty years. This is BYD’s car-making story and a microcosm of Chinese brand car manufacturing.”

Upon the release of BYD’s theme video “Together, We Are Chinese Cars,” Ideal Car investor and Meituan CEO Wang Xing shared the video on his social media with the comment “Tears in my eyes.”

Without a doubt, this belongs to the automotive world’s “BYD Moment.”

However, amidst the celebrations, what the automotive world truly ponders is, when we witness the 5 millionth new energy vehicle roll off the line at BYD, what are we really witnessing?

-

A Tale of Persistence

Since its dedicated entry into the new energy sector in 2003, persevering through 10 years of hybrid technology commitment, a decade of lackluster sales, and even cash flow crises, BYD remains steadfast.

In 2003, when acquiring Xi’an QinChuan, Wang Chuanfu asserted, “Xi’an QinChuan can serve as an entry point for entering the Chinese electric vehicle market.”

By 2006, BYD successfully developed the F3e electric car with iron phosphate batteries. However, due to policy imperfections and immature technology, it wasn’t until 2008 that BYD introduced the F3DM, the world’s first mass-produced plug-in hybrid car.

Yet this achievement didn’t translate into consumer acceptance; over two years, F3DM’s cumulative sales remained a meager 417 units.

From 2010 to 2019, BYD’s average annual sales stood at 462,000 vehicles, with an average net profit of only 1.89 billion RMB, despite investing a substantial 43.4 billion RMB in research and development.

Throughout this decade, the penetration rate of conventional vehicles continued to rise, benefiting most traditional automakers. However, BYD’s sales repeatedly languished, and the high R&D investments caused several key technical personnel to leave BYD’s research institute.

At BYD’s 20th-anniversary conference in 2014, Wang Chuanfu shed tears in front of over 700 senior employees, emphasizing technology’s importance to BYD.

“It was a time of indescribable bitterness. We didn’t know what to do next. At that time, BYD’s sole objective was survival.”

From 2010 to 2019, it can be said that BYD faced a dark period before dawn, experiencing a decade of lackluster sales and fruitless technology investments.

In 2019, BYD’s annual sales reached 461,400 vehicles, of which 219,400 were new energy models, accounting for less than 50% of total sales. Historical net profit reached a low of 1.6 billion RMB. However, BYD invested a substantial 8.4 billion RMB in R&D during that year, comprising 6.59% of its revenue.

This proportion is comparable to BMW’s R&D investment level, despite BMW’s sales being twice that of BYD’s in the domestic automotive market that year.

In the same year, BYD extended its ambitions to capacity expansion (adding factories in Changsha, Zhongshan, and Xi’an), developed iron phosphate lithium technology for blade batteries, and established five independent Fudi series companies to vertically integrate its supply chain.

On one hand, net profits continued to decline, and on the other, R&D investment continued to rise.

Wang Chuanfu also feared making the wrong decisions.

In 2018, when developing the third generation of DM hybrid technology, Wang Chuanfu almost gave up because China’s plug-in hybrid market was very small at that time, and the technology required further optimization and breakthroughs, facing significant uncertainty.

In 2018, China’s new energy vehicle sales exceeded 1 million vehicles for the first time, growing by 61.7% YoY. However, the plug-in hybrid market had a tiny share, accounting for only 21.6% (271,000 vehicles) of total new energy vehicle sales.

“At that time, many automakers abandoned the development of plug-in hybrids. BYD internally also proposed giving up. Still, I made the decision to continue with the plug-in hybrid route, insisting on persevering, even if we made mistakes. We’ve tried every feasible path.” Wang Chuanfu said.

This investment finally began to yield returns.

In 2021, BYD’s hybrid vehicle sales reached an astonishing 273,900 vehicles, growing over four times compared to 2020. Although DM hybrid models accounted for only 45% of total new energy vehicle sales for the year, compared to EV pure electric models’ 1.4 times growth, hybrid models were the key to BYD’s sales surge in 2021.

Long-term R&D investment and dedication to the new energy sector have positioned BYD advantageously in intense competition.

In 2021, BYD introduced the DM-i super hybrid technology, and models like the Qin and Song, featuring DM-i hybrids, became bestsellers, capturing sales crowns in their respective categories. Meanwhile, other brands only started mass-producing PHEV hybrid models in the past two years.

In terms of sales data, from 2023 to the present, BYD’s monthly average sales reached 261,000 vehicles, totaling 1.82 million vehicles, nearing last year’s annual sales (1.8 million vehicles). This achievement is 61% towards the goal of achieving 3 million annual sales this year.

With foresight and technological preparation, BYD has already taken the lead in global new energy vehicle sales, a result of Wang Chuanfu’s 20 years of unwavering dedication.

-

A Display of Courage

Whether becoming the world’s first automaker to cease internal combustion engine production or adopting an oil-electric pricing strategy to snatch customers from traditional fuel cars, every move embodies BYD’s determination and courage.

Firstly, the turning point brought by hybrid sales.

BYD was the first Chinese automaker to challenge Japanese dominance, introducing the DM-i super hybrid platform.

Wang Chuanfu mentioned that while pure electric vehicles addressed additional purchase needs, plug-in hybrids effectively catered to first-time buyers and upgraders, creating a noticeable substitution effect for the vast existing fuel car market.

For example, the BYD Qin Plus DM-i, priced from 99,800 to 145,800 RMB, directly competes with popular models like Nissan Sylphy and Volkswagen Lavida, which fall within the same price range in the Chinese passenger car market.

Moreover, the lifecycle cost of the BYD Qin Plus DM-i is around 200,000 RMB, compared to Toyota Corolla’s similar cost of around 260,000 RMB.

Looking at the results:

Before 2020, Japanese HEV models dominated the market, with Toyota and Honda’s hybrid models commanding a significant share of the Chinese hybrid market. However, between 2021 and 2022, Japanese hybrid market share declined by 13%, while BYD’s market share increased by 16.5%.

Secondly, enhancing brand value through upscale development.

From the F3, which debuted in 2005 and had a maximum price of under 100,000 RMB, to models priced from 300,000 to 600,000 RMB that compete with brands like BMW, Benz, and Audi, and even luxury models priced over 1 million RMB.

For BYD, these breakthroughs were unprecedented.

Wang Chuanfu’s most appreciated segment is the luxury sector, aiming to demonstrate BYD’s value by benchmarking against luxury brands.

In segmented markets:

The upcoming Yuanwang will utilize BYD’s cutting-edge technology to offer peak performance at a premium price; The Fangcheng Leopard focuses on the 400,000 to 600,000 RMB personalized market. Its debut model, Fangcheng Leopard 5, aims to rival the Mercedes G-Class in terms of performance. After five consecutive months of over 10,000 unit sales, the Tang N7 competes against fuel-powered models like the Mercedes GLC, BMW X3, and Audi Q5L. Tang will also introduce an executive sedan and coupe, positioned against the Mercedes S-Class and Porsche Panamera, respectively. On the technology front, BYD has achieved “full-stack self-reliance” in batteries and vehicle electronic systems. It has also introduced technologies like “Easy Turn” that enables turning in place and the “Cloud Chariot System” allowing three-wheel motion and stationary jumping.

Lastly, embracing the intelligent era of the second half of the new energy game.

People often joke that “BYD sells electric cars, while Tesla sells intelligent cars,” implying that intelligent driving is BYD’s Achilles’ heel.

Today, BYD has a clearer strategy: first, fill the gaps with suppliers and gradually transition to self-developed teams.

On the supplier level, BYD’s “DNP” advanced intelligent driving solution, built on the Horizon Journey 5, is equipped with an 11V5R sensor and Jurui Technology’s high-precision positioning service. It will integrate with Eastsoft RuiChi’s domain controller and debut in the new BYD Han in the third quarter of this year.

On the self-development level, BYD has begun self-developing core components like LiDAR, millimeter-wave radar, and autonomous driving chips. It plans to mass-produce a multi-camera fused BEV perception model within the year and already has a research team of over 300 vehicles.

From betting on the new energy path to fully impacting the high-end market, and seizing opportunities in intelligent driving—each step BYD takes in this ever-changing competitive market demands sufficient courage.

As of now, BYD has over 90,000 R&D engineers, and 11 research institutes, and averages 15 patent authorizations per working day.

As Wang Chuanfu said, in 2014, China’s brand market share experienced 12 consecutive drops in the face of the harshest challenges. Our products, technology, and services weren’t recognized. Many Chinese brands were on the brink. We never considered giving up, firmly believing that the era of Chinese brands would eventually arrive.

Looking back, BYD exchanged the dividend of hybrid technology for an upper hand in the first half, while the next technological cycle involves feeding the high-end market and making a breakthrough in the intelligent driving race.

-

Observing a Framework

In Wang Chuanfu‘s speech of over 20 minutes: he mentioned China 68 times, cars 59 times, new energy 32 times, and the world 17 times. Wang Chuanfu concluded his speech with the phrase “Together, we are China’s cars,” igniting the climax of the event.

On Weibo, prominent user @理记 commented: Wang Chuanfu’s speech, whether in terms of intent, diction, structure, or depth, can be hailed as the best speech of 2023. The entire speech is divided into three sections, where only the first part talks about BYD itself, while the remaining two discuss the development and prospects of China’s new energy, instantly elevating the perspective to a higher level.

In BYD’s promotional video “Together, We Are China’s Cars,” the footage looks back on significant moments of nearly every brand, from the first domestically produced car seven decades ago to the present.

This compilation includes not only traditional automakers that witnessed the origin of China’s automotive industry but also the emerging forces striving to catch up. Both represent China’s automotive brand system capability and currently the world’s highest level of automotive intelligence.

When it comes to the reserves of funds and talent, vertical integration is BYD’s major advantage.

However, supply chain resources are advantages for traditional major automakers like FAW, SAIC, and Geely.

Emerging players accelerated the electrification and intelligence of cars through bold investments.

Whether it’s in the three-electric technology or advanced driver assistance, Chinese automotive brands have enough confidence to compete with overseas counterparts.

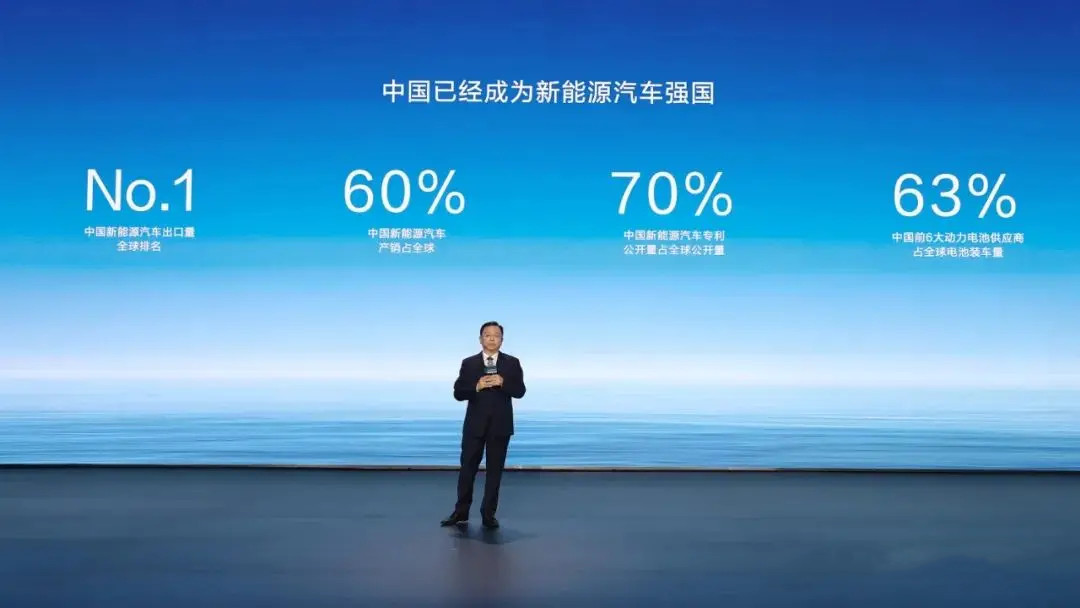

As Wang Chuanfu put it, in the past, Chinese automotive brands struggled to catch up with market trends, lacking a globally renowned brand. However, today China has become a strong nation in new energy vehicles, mastering core technology and a comprehensive industrial chain. The automotive industry is no longer “stuck.”

In other words, mutual entanglement is an essential exercise for every automaker, a reflection of the collective sprint of Chinese automotive brands.

Toyota “learning from” BYD, Volkswagen China investing 5 billion RMB to partner with Xiaopeng, Audi signing a strategic memorandum with SAIC Group, and Zeroscape negotiating technological cooperation with overseas automakers—all these cases clearly illustrate that Chinese automotive brands are beginning to exert a certain influence on the global automotive market.

In this vast global automotive market, it took 10 years for China’s new energy vehicle penetration to surpass 1%. From 2016 to 2019, penetration reached 5%. Starting in 2020, China’s new energy penetration has doubled for two consecutive years, reaching 32.4% in the first half of this year.

Wang Chuanfu predicts that by 2025, the penetration rate of new energy vehicles in the Chinese market will exceed 60%, accounting for over 70% of the global share. BYD, along with brands like Geely, Great Wall, FAW, and NIO, will strive to become true world-class brands.

For BYD, two decades of perseverance have led to breakthroughs.

BYD’s first mass-produced new energy vehicle was the F3DM, and the 5 millionth was the Tang N7.

The production of the 5 millionth new energy vehicle is a milestone for BYD and marks a new beginning for China’s new energy industry. This also signifies that BYD, as a national brand in the new energy vehicle sector, has finally reached its “BYD Moment.”

“New energy is irreversible, and Chinese brands have immense potential.” We look forward to the milestone of 10 million vehicles produced by BYD and anticipate the glorious moments of other Chinese automotive brands.