To ensure the delivery pace for the first half of 2024, Xiaomi’s car division is accelerating the construction of its delivery centers and flagship stores.

As reported by “Car Realm,” starting in July, Xiaomi’s car division has begun the construction of 10 major delivery centers. The initial cities include Beijing, Shenzhen, Chengdu, and Xi’an, among others. Additionally, they will prioritize establishing flagship stores in first-tier cities dedicated to showcasing Xiaomi’s cars. Currently, these locations are in the site selection phase.

Store channels form the fundamental base that automotive brands need to solidify.

By 2022, Xiaomi had already amassed over 10,000 stores nationwide.

It is worth noting that most Xiaomi stores are positioned in prime commercial areas, with floor spaces ranging from 100 to 460 square meters. Setting aside a dedicated area within these stores for car sales would not incur additional costs.

These stores will naturally serve as sales channels for Xiaomi’s cars.

“Ahead of time, Xiaomi’s new cars will be displayed in Xiaomi stores, and later adjustments will be made based on the number of new cars,” revealed an industry insider to “Car Realm.”

With less than a year left until the anticipated market launch, Xiaomi’s car division’s product and distribution strategy has entered the pre-production sprint phase.

-

Focusing on service experience, prioritizing fully direct sales channels in first and second-tier markets.

Being one of the highest-priced consumer products, cars require robust offline distribution channels for both sales and deliveries.

This is because sales channels are directly tied to the user experience.

Since Tesla introduced the supermarket model, both new and traditional car manufacturers have followed suit and even further iterated on it.

For instance, Li Auto introduced the concept of supermarket stores (showrooms and retail centers) combined with delivery centers, bearing similarities to Tesla’s early model.

Xiaopeng Motors (XPeng) adopted Li Auto’s model and also drew inspiration from NIO’s social space concept, resulting in XPeng Centers. These centers serve as places for exhibitions, experience, sales, and social interaction for car owners.

Tesla, Li Auto, and XPeng can be considered the quintessential representatives of expanding distribution channels and have all achieved sales leadership in their respective niches.

According to reports from “Che An Ren An,” Xiaomi’s car distribution system will be comprised of retail centers, delivery centers, and service centers.

The advantage of such a layout lies in the establishment of a self-owned direct sales and service system, encompassing retail centers, delivery centers, and maintenance centers. This all-channel planning will bring about more unified and efficient services.

New entrants into the automotive market can quickly accumulate a positive reputation by focusing on the entire user experience. This includes everything from maintaining a direct-sales approach, involving users in co-creation, setting up self-owned charging and battery swapping stations, to providing comprehensive repair and maintenance services. This holistic approach covers the entire lifecycle of a vehicle, significantly enhancing the user experience.

This is an aspect that Xiaomi’s Mi Home stores were not particularly adept at in the past.

According to the Weibo account @长三角行健者 (Yangtze River Delta Traveler), Xiaomi’s delivery centers require candidate locations to provide at least 120 parking spaces, with a minimum building area of 3000 square meters.

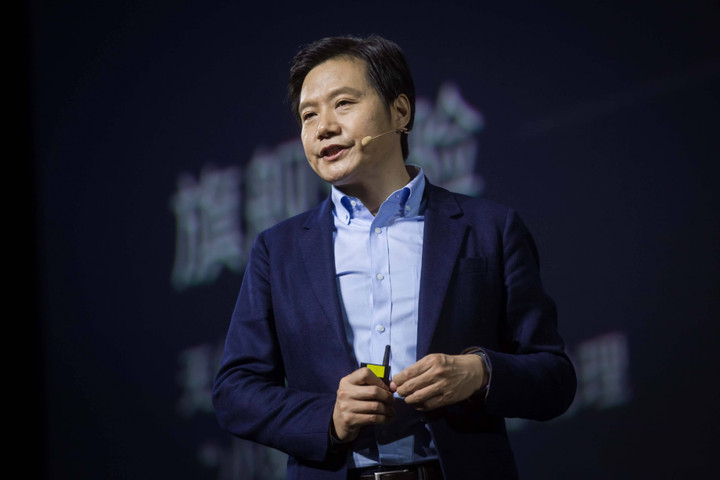

It’s understood that Lei Jun, the founder of Xiaomi, has also been visiting some large dealer groups in the Yangtze River Delta while attending the Xiaomi supplier ecosystem conference to learn about automotive marketing practices.

According to the plan, Xiaomi’s car division will commence the construction and site selection for the initial 10 major delivery centers and flagship stores in July of this year. The Xiaomi International Headquarters in Shenzhen’s Nanshan District will also become Xiaomi’s global flagship store for cars.

Overall, distinct from the outsourcing approach commonly adopted by traditional brands, Xiaomi’s car division has chosen to prioritize a focus on service experience and prioritize fully direct sales channels. This approach is in line with the channel advantage derived from Huawei’s two-year exploration of its “Huawei Select” model.

In Lei Jun’s perspective, online and offline channels complement each other. First and second-tier markets will primarily be served through fully direct sales, while authorization and agency models are seen as supplementary.

However, this more advanced channel system will also pose challenges to brand management and service capabilities. To maximize coverage within the user ecosystem and drive innovation, Xiaomi’s car division needs to explore further.

-

Xiaomi’s Electric Cars: The “Toyota” of the Electric Car Era?

At present, Xiaomi’s car production process is steadily advancing.

In May of this year, Lu Weibing, the Partner and President of Xiaomi Group, stated that Xiaomi’s car manufacturing has entered the accelerated development stage and will begin testing in the summer and winter of this year.

On July 4th, Xiaomi’s car supplier FAW Fuwei, when asked about the collaboration with Xiaomi’s car division, indicated on its interactive platform:

“We are actively engaging in business communication with Xiaomi’s car division, and several subsidiaries have joined Xiaomi’s car procurement team. Currently, the first model of Xiaomi’s car has been priced.”

Not long ago, there were reports on the internet stating that Xiaomi’s first car will be launched in two versions: Standard and Pro.

The former will have a rear-wheel-drive single motor configuration, with a WLTC range of around 800 kilometers; The latter will have a four-wheel-drive dual motor configuration, with a WLTC range of about 700 kilometers; The starting prices for the two versions are 149,900 yuan and 179,900 yuan, respectively.

Although Xiaomi’s spokesperson, Wang Hua, denied the rumors, most people believe that these price points align with the positioning and expectations for Xiaomi’s cars.

Subsequently, some netizens joked that if not for this, one could only look forward to the “Redmi Car.”

As early as April 2021, Lei Jun initiated three polls on Weibo:

What type of car would you like Xiaomi’s first car to be? Regarding Xiaomi’s car brand, should the “Xiaomi” brand be used or a new brand be created? What would you expect the price of Xiaomi’s first car to be? Lei Jun later revealed the poll results: “Today’s Weibo poll results show that fans hope we make a mid-to-high-end car, so the price range of Xiaomi’s first car is between 100,000 and 300,000 yuan.”

Although user surveys showed a high demand for Xiaomi models priced below 100,000 yuan, this price point does not align with Xiaomi’s car division’s brand strategy.

In 2022, insiders revealed to “CarNewsChina” that Xiaomi’s car division is primarily targeting mid-to-high-end models:

Mid-range models, priced between 150,000 and 200,000 yuan for A+ class vehicles (Level 2+ autonomous driving); High-end models, priced between 200,000 and 300,000 yuan for B-class vehicles (Level 3 autonomous driving). Focusing on vehicles priced from 150,000 to 300,000 yuan, this range is similar to the current 3,000 yuan smartphone market. It is expected to be the most crowded, competitive, and potentially high-turnover segment in the electric vehicle market.

Subsequently, news from “LatePost Auto” showed that Xiaomi’s first model would be a mid-sized fastback sedan (internally known as “Modena”), available in two different versions based on a three-electric system and intelligent driving:

The low-cost version of Modena, based on a 400V platform with BYD lithium iron phosphate battery and equipped with Continental’s 5R1V (5 millimeter-wave radars, 1 camera) multi-sensor fusion solution for intelligent driving, similar to the solution used in the 2021 model Ideal ONE. The high-cost version of Modena is based on an 800V high-voltage platform with a CATL battery, achieving 80% charge in 15 minutes. It features an NVIDIA Orin X chip for intelligent driving, lidar, and Xiaomi’s proprietary software.

From the start, Lei Jun set the tone for Xiaomi’s cars: “The first electric car for young people,” with cutting-edge technology and quality.

Clearly, reducing the price of electric cars is one of Xiaomi’s immediate priorities.

So, does Xiaomi’s car division have the ability to cut prices?

Objectively, sales volume is the ultimate goal for all new energy vehicles, and the price is one of the shortcuts to achieving this goal.

Currently, the players who have been dubbed “price butchers” are only Tesla and BYD:

The former is due to factors such as a mature supply chain, domestic production of components, and large-scale production. The latter is the result of years of refining their vertically integrated supply chain. Both models require time accumulation and mature technological support.

Xiaomi’s car division, which lacks this capability, may only be able to sell cars at a loss in the early stages.

According to 36Kr’s report, Xiaomi’s car division is currently dismantling various links in logistics, supply chain settlement, and R&D to minimize costs.

Improving efficiency through technological innovation to create products that are both high-quality and cost-effective is Lei Jun’s approach from when he founded Xiaomi.

This approach is still applicable to Xiaomi’s car division.

Applying this approach to the entire automotive industry, the Nissan Sylphy, Toyota Corolla, and Volkswagen Lavida can be seen as classic representative models.

With the clever balance of “cost-quality-efficiency,” Sylphy, Corolla, and Lavida have become globally bestselling household cars for many years.

If we focus on the field of intelligence, the XPeng G6, in terms of both product capabilities and pricing, seems to be the kind of smart car Xiaomi most wants to create.

According to 36Kr, Lei Jun once decisively streamlined Xiaomi’s car division in a senior executive meeting, proposing a focus on resources to create the first explosive product model. Some non-urgent research and development projects were put on hold, and both 400V and 800V high and low voltage configurations were determined to ensure pricing flexibility, while advanced intelligent driver assistance systems were essential.

According to incomplete statistics:

Currently, most mainstream pure electric vehicle models on the domestic market are based on the 400V voltage platform, with prices starting at least from 139,600 yuan (e.g., Aiways Aion S PLUS).

There are only 8 models that use the 800V voltage platform, with the lowest starting price being 209,900 yuan for the XPeng G6.

If you add the option of advanced intelligent driver assistance, whether it’s on the 400V platform or the 800V high-voltage platform, the XPeng G6 is currently the only model with the lowest price on the market.

In the eyes of Xiaomi fans, Xiaomi’s cars have performance comparable to Tesla, with excellent interactions and super-cool smart experiences.

In the eyes of ordinary consumers, Xiaomi’s cars represent affordable and reliable products that can be purchased without extensive research.

The positioning of cost-effective family cars is advantageous for quickly establishing Xiaomi’s manufacturing system and is also the secret behind Toyota’s explosive product strategy.

However, if the positioning of “Xiaomi” and “young people’s first car” is placed in the high-end smart car market, at least currently, this business logic is difficult to achieve.

-

Factory Completion: Has Xiaomi Solved its Production Qualifications?

In the era of traditional internal combustion engine cars, a new car that was not initially noticed could still turn around and become a bestseller if the product was good enough, combined with more attractive terminal prices, and strong channel resources.

The Volkswagen New Santana, Toyota Corolla, and Chevrolet Cruze are representative models in this regard.

But in the era of intelligent electric cars, market iteration is faster than with internal combustion engine cars. If a new car is not impressive enough at its initial release, it’s difficult to find an opportunity to turn around its sales performance.

Only by quickly gaining traction in the market, capturing user brand loyalty and product sales through strength and volume, can brands and products have the chance to play again.

So, is Xiaomi’s timing for entry too late?

Lei Jun believes that the automobile industry is a hundred-year track, and as long as you have confidence in the industry, it’s never too late. New car-making forces laid out their automotive strategies 6-7 years ahead of Xiaomi, but Xiaomi’s advantage lies in electronic technology and user experience.

Combining public information reveals traces of Xiaomi’s first car (internally code-named “Modena”): fully self-developed, lidar, CATL battery, the 8295 chip, positioned as a mid-sized fastback sedan.

Industry insiders also suggest that Xiaomi’s first car will use self-developed chips and in-car systems.

From a product perspective, such configurations do indeed meet Lei Jun’s criteria for “cutting-edge technology.” However, for Xiaomi’s car division, which lacks an integrated supply chain and manufacturing capabilities, good products must also withstand the tests of production capacity and quality management.

To ensure the steady operation of the supply chain, Xiaomi brought in an experienced veteran from the automotive industry—Huang Zhenyu.

Huang Zhenyu was formerly the Vice President of Magna China, a global supplier, and was involved in the production of the BAIC Arcfox Alpha T. He has rich experience in supply chain control.

After assigning the supply chain responsibilities to Huang Zhenyu, Li Xiaoshuang, the Deputy General Manager of Xiaomi’s car division, shifted his focus to the marketing business. He will also serve as the General Manager of the car division’s marketing department, reporting to the car division’s CEO, Lei Jun.

Of course, whether Xiaomi can actually manufacture cars depends on whether they have the production qualifications.

It is reported that Xiaomi’s car division has already obtained the production qualifications for automobiles from relevant authorities. The specific license issuance process does not involve acquiring a traditional car company that has ceased production. Instead, it most likely comes from new approvals from the regulatory authorities.

Xiaomi’s car factory in Beijing’s Yizhuang district has completed construction and acceptance in June, with some equipment moved into the factory, including core equipment such as integrated die-casting machines. Trial production is about to begin, and information confirming the licenses is expected to be available in July or August.

According to the plan, Xiaomi’s car factory, with an annual production capacity of 300,000 vehicles, will be completed in two phases. The first phase has been completed on schedule (June 2023), while the second phase is set to start in March next year and is expected to be completed in March 2025.

If the above information is accurate, it means that Xiaomi’s car division has taken another significant step forward in its development.

Of course, compared to the new car’s launch in the first half of 2024, the outside world is more concerned about how Xiaomi’s car division will achieve profitability.

Xiaomi once stated that the “comprehensive profit margin of hardware will never exceed 5%.” If this principle is still upheld in car manufacturing, how will this “income-expense” balance be achieved through operations?